Buying or Selling a home Can be Stressful! 😵

The Experienced Greetings DMV Sales Network Agents Will Help You Find YOUR Home Or Sell Your House,

So You Have More Money, Comfort, And Achieve Your Goals Throughout The Process.

Should You Get a Lender?

So your offer was just accepted by the seller. You also finished the home inspection, and you’re now in the stage of finalizing the financing. You’re finally getting close to acquiring the home and have decided you won’t talk to a lender.

This is because you’ve got great credit or even great income. Still, the problem with not talking to a lender is that you’ll risk losing the entire transaction and waste everybody’s time in the process if an issue arises concerning your financing.

So, why is talking to a lender that important? Let’s dive deep into the importance of talking with one.

Talking To A Lender

Being introduced to a lender can provide various benefits that make the transaction process smoother. This is because a lender will be able to know the right questions to ask you to ensure that there are no pitfalls in the transaction.

During the conversation with a lender, expect they will ask you to share things like your pay, credit, last couple of pay statements, tax returns, and other things they need information on.

Lender’s Criteria To Get You A Loan

Lenders evaluate several criteria when determining your eligibility for a loan. These criteria help lenders assess your financial stability, creditworthiness, and ability to repay the loan.

For them to make a lending decision and give you a loan, the lenders have to make sure that you can repay the loan and that the collateral is sufficient in terms of its monetary value in case you can’t repay it. These criteria boil down to determining if they can get their money back.

Conclusion

Buying a home involves a lot of complex processes, and buyers like you have a significant financial commitment that often requires borrowing a substantial amount of money. Lenders provide a lot of financial support and expertise to help buyers like you understand complex financial matters and have the necessary capital to make one of the most significant investments of your lives.

This financial support empowers buyers like you to fulfill your homeownership aspirations, allowing you to secure a property and build equity over time.

If you want to know more, feel free to reach out to me at (703) 562-1788 or Dan@greetingsvirginia.com. I’d be more than happy to explain to you in-depth the necessary steps with regards to talking to a lender.

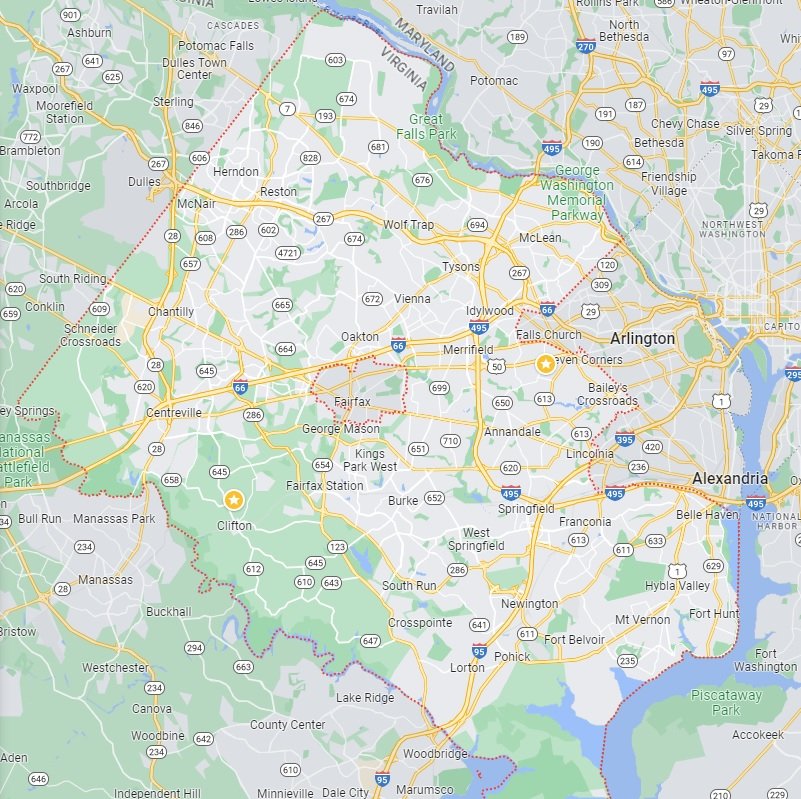

Fairfax County Homes for Sale

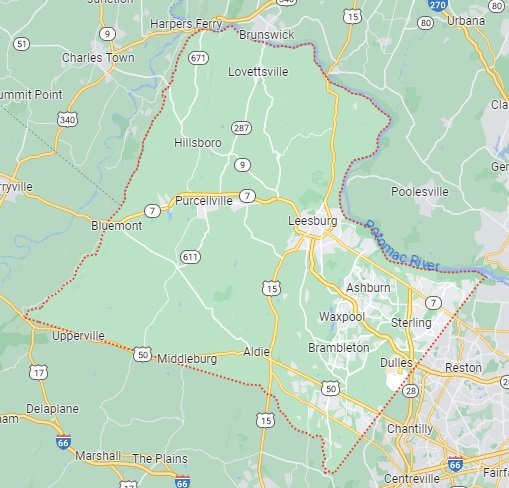

Loudoun County Homes for Sale

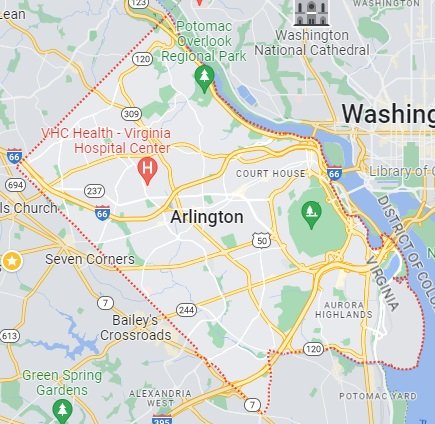

Arlington County Homes for Sale

Prince William County Homes for Sale