Buying or Selling a home Can be Stressful! 😵

The Experienced Greetings DMV Sales Network Agents Will Help You Find YOUR Home Or Sell Your House,

So You Have More Money, Comfort, And Achieve Your Goals Throughout The Process.

MAKING A HOUSING DECISION: PROS AND CONS YOU SHOULD KNOW

The usual notions people have about renting or buying are not always true. There is no “one size fits all” approach in looking for a home when deciding between these two pathways. Both have different values that fit various kinds of people, so it is more about preference.

People usually have a lot of preferences when considering where to live. This could be their lifestyle, location, goals, and more, unique to each homebuyer. You must determine these first before deciding between renting or buying.

Both choices are great, but only if you narrow down the details of your housing decision. Let’s dive into understanding renting and buying and what you must consider when deciding.

Renting A Home

Renting a home means leasing a property from a landlord or property management company for a specified period, typically from month-to-month to several years. Contrary to common misconceptions, renting offers flexibility and freedom from many responsibilities associated with homeownership.

One of the common myths is that renting is "throwing money away." Still, it provides a roof over one's head without the financial commitments of property taxes, maintenance costs, or mortgage payments.

However, there are essential considerations for renters to keep in mind. It's crucial to thoroughly review the terms of the lease agreement, including rental rates, utility responsibilities, and any restrictions or regulations imposed by the landlord or property management. While renting offers flexibility, tenants should be prepared for potential rent increases and eviction if they fail to abide by the lease terms.

Advantages of Renting

Flexibility: Renting offers the freedom to relocate quickly without the commitment of selling a property.

No Property Maintenance: Landlords typically handle maintenance and repair issues, alleviating the responsibility and cost for renters.

Lower Upfront Costs: Renting often requires a smaller upfront financial commitment than purchasing a home, which can include a down payment, closing costs, and ongoing expenses like property taxes and homeowner's insurance.

Fixed Monthly Expenses: Renters typically have predictable monthly expenses, as rent payments remain stable for the lease term (unless specified otherwise).

Access to Amenities: Many rental properties offer access to amenities such as pools, gyms, and communal spaces, which may be costly to install and maintain in a personal residence.

Disadvantages of Renting

Lack of Equity: Renters do not build equity in the property over time, as they would with homeownership, meaning they do not benefit from potential property value appreciation.

Limited Control: Renters may face restrictions on customization or renovations to the property, as significant alterations typically require landlord approval.

Rent Increases: Landlords can increase rent prices at the end of lease terms or with proper notice, potentially leading to higher housing costs over time.

Uncertain Tenure: Renters may face the risk of eviction if they fail to comply with lease terms or if the landlord decides to sell the property or terminate the lease for any reason.

No Tax Benefits: Unlike homeowners, renters do not benefit from tax deductions related to mortgage interest or property taxes, potentially missing out on financial incentives.

Buying a Home

Buying a home means making a big financial commitment and taking on the responsibility of owning property. Despite what some may think, it's not just about mortgage payments; taxes, insurance, and upkeep costs are also to consider. While many believe owning a home is always a significant investment, it's important to remember that the housing market can be unpredictable. There are potential expenses that could affect its value.

Before buying, assessing your financial readiness and long-term plans is crucial. Ensure you're stretching your budget enough and understand all the costs, including those beyond the purchase price. Conduct thorough inspections and research on the property to avoid surprises and ensure you're making a wise investment for your future.

Advantages of Buying

Building Equity: Homeownership allows you to build equity over time, providing potential financial stability and long-term wealth.

Stability: Owning a home offers stability and a sense of permanence, as you have control over your living space without the risk of sudden rent increases or lease terminations.

Investment Potential: Real estate has historically proven to be a valuable long-term investment, with the potential for property appreciation and the opportunity to generate rental income if desired.

Tax Benefits: Homeowners may benefit from tax deductions on mortgage interest, property taxes, and certain home-related expenses, potentially reducing their overall tax burden.

Pride of Ownership: Buying a home allows you to personalize and customize your living space according to your preferences, fostering a sense of pride and ownership in your property.

Disadvantages of Buying

Financial Commitment: Purchasing a home requires a substantial financial commitment upfront, including a down payment, closing costs, and ongoing mortgage payments.

Maintenance Costs: Homeowners are responsible for all maintenance and repair expenses, including costly repairs for unforeseen issues such as plumbing or structural problems.

Limited Flexibility: Unlike renting, owning a home ties you to a specific location, making it more challenging to relocate for work or personal reasons without the complexities of selling the property.

Market Risks: The value of a home can fluctuate over time due to changes in the housing market, economic factors, or shifts in neighborhood desirability, potentially impacting your investment.

Additional Expenses: Beyond mortgage payments, homeowners incur additional expenses such as property taxes, homeowners insurance, and possibly homeowner association (HOA) fees, which can increase the overall cost of homeownership.

If you want to know more about renting and buying a home, feel free to reach out to me at (703) 562-1788 or Dan@greetingsvirginia.com. I’d be more than happy to help you!

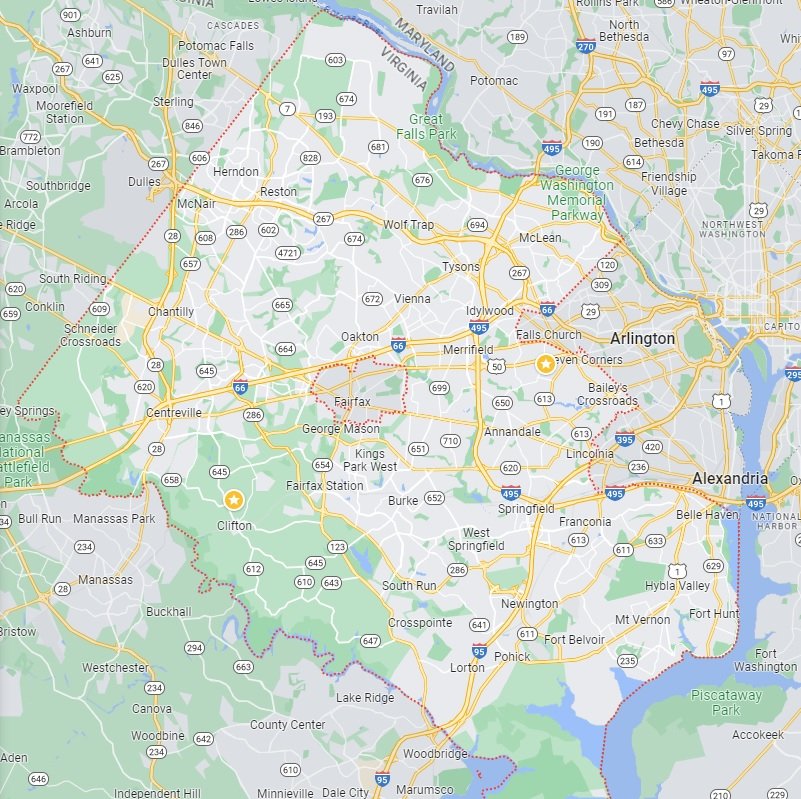

Fairfax County Homes for Sale

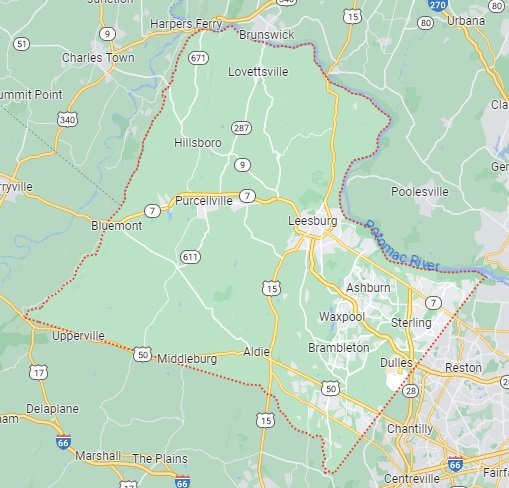

Loudoun County Homes for Sale

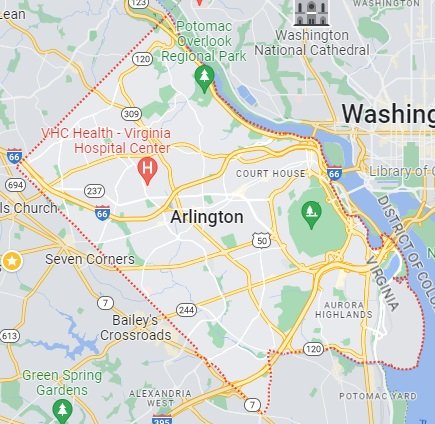

Arlington County Homes for Sale

Prince William County Homes for Sale